Journal Statistics reported by Crossref

The recently introduced Virtus Interpress platform is a new part of the open access policy – Virtus Scholar Statistics Platform. With this initiative, we stand by the idea that open access publishing is the future of scholarly publishing. There must be an opportunity for scholarly research to be shared freely among the researches around the world. This is crucial in erasing the boundaries and enhancing future cooperation.

It is necessary to remind that statistics generated through our Virtus Scholar Statistics Platform is a separate part of global statistics.

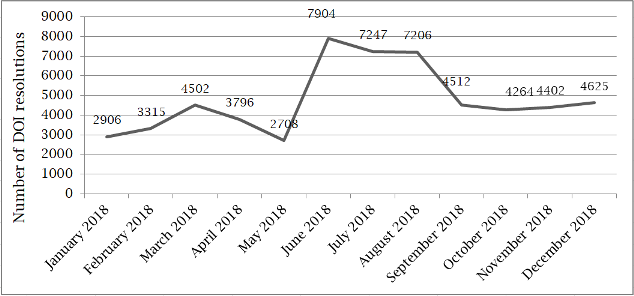

Here, we would like to present another part of views statistics which is generated by an external platform. The statistics below was provided by CrossRef.

These numbers give an indication of the traffic coming to the publisher’s site from users clicking DOIs. The DOI links are largely from links in other publishers’ journal references to our articles, but they are also from DOI links in secondary databases, links from libraries using DOIs, and even DOIs in used in print versions.

When a researcher clicks on a DOI link for one of our articles, that counts as one DOI resolution. The following figures and article rating provide an important measure of the effectiveness of our participation in CrossRef.

First of all, here is the last month top-10 of the most popular articles published by Virtus Interpress (based on the total number of DOI resolutions):

- Gottschalk, P. (2017). Convenience in white-collar crime: A resource perspective. Risk governance & control: financial markets & institutions, 7(2), 28-37. https://doi.org/10.22495/rgcv7i2art3

- Stenheim, T., & Madsen, D. Ø. (2017). The shift of accounting models and accounting quality: The case of Norwegian GAAP. Corporate Ownership & Control, 14(4-1), 289-300. https://doi.org/10.22495/cocv14i4c1art11

- Silkoset, R., Nygaard, A., & Kidwell, R. E. (2016). Differential effects of plural ownership and governance mechanisms in limiting shirkers and free riders. Corporate Ownership & Control, 13(2), 113-131. https://doi.org/10.22495/cocv13i2p12

- Santen, B., & Donker, H. (2009). Board diversity in the perspective of financial distress: Empirical evidence from the Netherlands. Corporate Board: role, duties and composition, 5(2), 23-35. https://doi.org/10.22495/cbv5i2art3

- Bronk, C. (2014). Corporate risk, intelligence and governance in the time of cyber threat. Risk governance & control: financial markets & institutions, 4(1), 16-22. https://doi.org/10.22495/rgcv4i1art2

- Dzomira, S. (2014). Electronic fraud (cyber fraud) risk in the banking industry, Zimbabwe. Risk governance & control: financial markets & institutions, 4(2), 17-27. https://doi.org/10.22495/rgcv4i2art2

- Kang, H., Leung, S., Morris, R. D., & Gray, S. J. (2013). Corporate governance and earnings management: An Australian perspective. Corporate Ownership & Control, 10(3), 95-113. https://doi.org/10.22495/cocv10i3art8

- Adegbite, E., Shrives, P., & Nichol, T. (2011). The role of government in corporate governance: Perspectives from the UK. Corporate Ownership & Control, 9(1-2), 283-293. https://doi.org/10.22495/cocv9i1c2art3

- Al-Baidhani, A. M., Abdullah, A., Ariff, M., Cheng, F. F., & Karbhari, Y. (2017). Earnings response coefficient: Applying individual and portfolio methods. Corporate Ownership & Control, 14(3-1), 188-196. https://doi.org/10.22495/cocv14i3c1art4

- Velte, P. (2017). Do women on management board increase fair value relevance? Corporate Governance and Sustainability Review, 1(1), 6-16. https://doi.org/10.22495/cgsrv1i1p1

The following figure presents the dynamics of the number of DOI resolutions for the last 12 months:

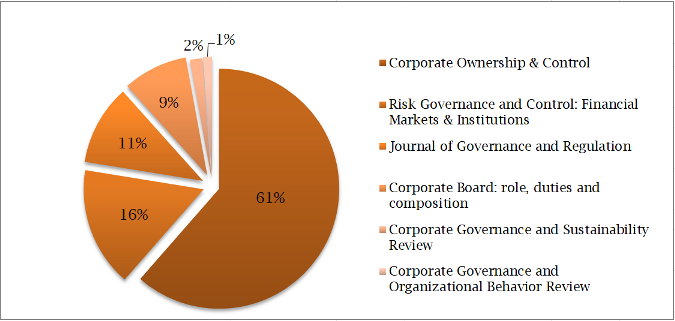

This diagram shows the resolution counts (in terms of separate Virtus Interpress journals) for the previous month:

We are planning to keep our network posted regarding download and views statistics provided by Virtus Scholar Statistics Platform and other external platforms.